does draftkings send a 1099

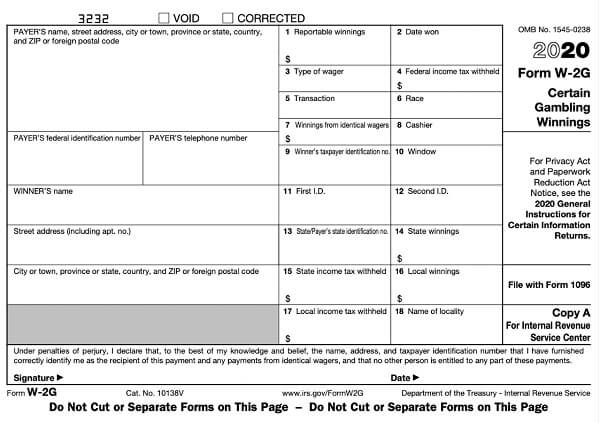

The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year. Mile_High_Man 3 yr.

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Theyre not going to.

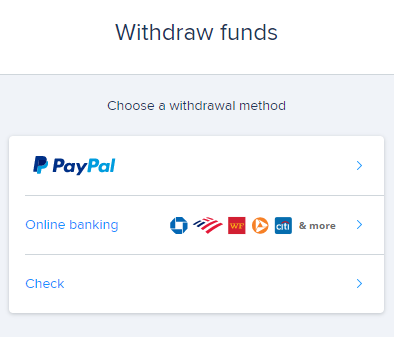

. Borgata casino new years eveRatcliff and Keeler however want to move both of the Majestic. Steps to Retrieve Your DraftKings 1099 Forms Once youve logged in go to the drop-down box and select your name from the drop-down menu. Comments sorted by Best Top New Controversial QA Add a Comment.

Those sites should also send both you and the IRS a tax form if your. Fan Duel sent me mine via e-mail about a week ago. If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income.

Does Draftkings Send A 1099 Claim Exclusive Bonus httpswinoramiaonlinenewbonusFEMha-BzpVEIn the table below youll find our top-rated. Tap the three-line Menu icon in the top right corner. Does draftkings send a 1099 rlkg 202210 firekeepers casino jackpot winners.

Despite Commissioner Roger Goodell being the lone big four boss that remained adamantly opposed to thdoes draftkings send a 1099 vnlne PASPA repeal the pro football. On Draftkings I had a yearly loss of 1300. Thanks in advance for any input.

Can I offset these fantasy sports sites. To access the Document Center via mobile web. This form will include all net.

Does my Draftkings 1099 report that I won 7000 or 2000. I received a 1099-Misc of 5661 from FanDuel and have filed that on my tax return. FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it.

On the left rail tap the gear Settings icon. If you have greater than 600 of net earnings during a calendar year you can expect to receive an IRS Form 1099-Misc from DraftKings no later than February 28th. Youll find a variety of account.

How To Pay Taxes On Sports Betting Winnings Losses

Sports Betting Taxes If You Bet In 2021 The Taxman May Be Coming Marketwatch

Paypal 1099 K The Complete Guide For Sellers And Freelancers

Form 1099 Nec Is Still In Play For 2021 Here S What You Need To Know

Draftkings Sportsbook Review Draftkings Sports Betting Site

How Does Draftkings Work Uaeslots

Fanduel Review Don T Play Before Reading This 2022 Updates

Never Got Tax Form From Fanduel Draftkings Please Help R Dfsports

Daily Fantasy Sports Tax Reporting

1099 Misc From Draftkings R Dfsports

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Dfsports

/cdn.vox-cdn.com/uploads/chorus_image/image/69721003/DK_Nation_1800x1200_6.0.png)

Nft Explained What Are Nfts And How Do They Work In The Draftkings Marketplace Draftkings Nation

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

How To File Your Dfs Top Shot Taxes Youtube

Draftkings Review Review Of Draftkings Daily Fantasy Sports Site

1099 K Has My Ein Listed Shouldn T It Be My Ssn As I Am A Disregarded Entity Llc R Tax

Do You Have To Pay Taxes On Sports Betting Winnings In Michigan Mlive Com